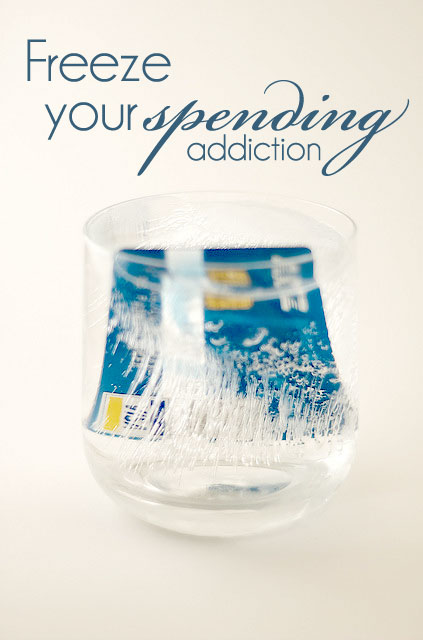

Do you often find yourself impulse shopping? I have come across several solutions to keep you from making a purchase too quickly most of which say take time to think about your purchase. Today I ran across a truly unique idea.

{photo cred: paalia on flickr}

The Discount Diva says to literally freeze your credit card. As in, put your credit card in water and stick it in your freezer.

Personally, this would not work for me because I use my credit card for gas and other necessities, but I do think it’s a very interesting idea.

Do you think this is something you might try?

i probably would do something like that, only to find a way to dethaw it the next day to get that new pair of shoes i’ve been wanting.

when i want to shop, nothing will stop me. not even a frozen credit card. lol

I did this! After abusing my credit card for only 3 months (and racking up almost $4000 in debt) I froze my credit card!

I used my CC for everything-groceries, gas, gifts, coffee-you name it. But I realized that there was no way I was going to pay off the debt and stop overspending unless I cut myself off. All of my credit cards sat in an envelope for 3 days in my purse. Then when I gave it to my bf to hide..and he threw it in a cupboard, I knew it wouldn't work. So I froze them. I went to a cash only system-It was tough. The first time I went to the grocery store I came home and cried that I was poor. I've had shopping urges and I know that since i don't have money there is no reason for me to even think about stepping foot in a mall.

Now, two months later, I have figured out a way to buy my christmas gifts without spending savings, or racking up a high-interest bill. I will have my CC paid off in 3 months-after working 4 jobs to do so! AND I don't plan to unfreeze that thing for quite a while…until I go on vacation.

The only downside was that I can't get my rewards now..but I've already decided to move all of my auto-pay bills to my CC. I can still earn rewards, and not have to touch that dreadful thing.

It was an eye-opening experience to see how easy it is to abuse your credit, and I also learned to enjoy the simple things when i got bored-instead of going to the mall. :)

I did this! After abusing my credit card for only 3 months (and racking up almost $4000 in debt) I froze my credit card!

I used my CC for everything-groceries, gas, gifts, coffee-you name it. But I realized that there was no way I was going to pay off the debt and stop overspending unless I cut myself off. All of my credit cards sat in an envelope for 3 days in my purse. Then when I gave it to my bf to hide..and he threw it in a cupboard, I knew it wouldn't work. So I froze them. I went to a cash only system-It was tough. The first time I went to the grocery store I came home and cried that I was poor. I've had shopping urges and I know that since i don't have money there is no reason for me to even think about stepping foot in a mall.

Now, two months later, I have figured out a way to buy my christmas gifts without spending savings, or racking up a high-interest bill. I will have my CC paid off in 3 months-after working 4 jobs to do so! AND I don't plan to unfreeze that thing for quite a while…until I go on vacation.

The only downside was that I can't get my rewards now..but I've already decided to move all of my auto-pay bills to my CC. I can still earn rewards, and not have to touch that dreadful thing.

It was an eye-opening experience to see how easy it is to abuse your credit, and I also learned to enjoy the simple things when i got bored-instead of going to the mall. :)